Greetings from the community, I will discuss the SymmetryFund Project and the following is the explanation:

The Symmetry Fund is designed to make it easier for individuals to invest in cryptography without the business, capital and risks associated with personal trading in the marketplace.

SYMM is perfect for investors who are looking for long-term and balanced investments, because SYMM is made for it. Funds of investors are used as capital for trading in various cryptos and the percentage of funds allocated for each currency is determined by certain currency and signal risks.

The following graphic explains how the flow of information in SYMM is structured.

The crypto price has increased in recent years and analysts see further increases in the medium to long term. During the famous Bitcoin, Ethereum is another cryptocurrency that attracts a great deal of investor interest due to its potential for infrastructure applications using blockchain technology.

Dana SYMM berinvestasi di Bitcoin, Ethereal, Dash, Lite Coin and Ripple sehingga dapat menawarkan portofolio terdiversifikasi bagi mereka yang mencari keamanan reksa dana tradisional, namun masih mendapat keuntungan dari kenaikan yang terjadi di pasar cardinal cardinal yang meningkat, terutama ICO yang menggiurkan. (Penawaran Koin Awal). Sebagai bagian dari Ethereal Blockchain, dana tersebut membayar dividen bulanan setara dengan 50% keuntungan perdagangan di ETH dengan sisa 50% diinvestasikan kembali, dengan pemungutan suara setiap tiga bulan sekali. Namun, unik untuk pasar kriptocurrency, investor di dana SYMM memiliki pilihan opsi buyback.

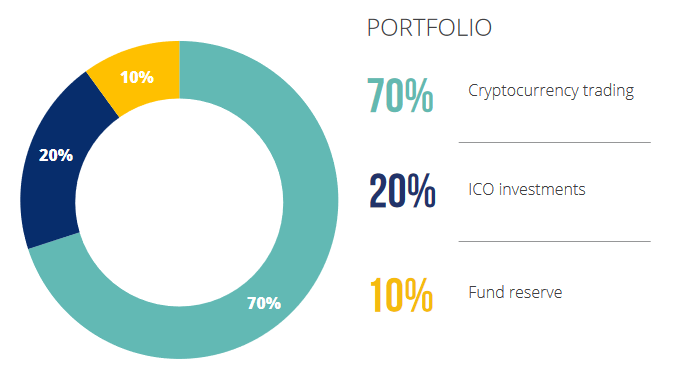

Manajer dana telah menyatakan bahwa tingginya tingkat transparansi terhadap keuntungan / kerugian dan dividen akan dipertahankan melalui pelaporan harian kepada investor, sementara dana cadangan sebesar 10% akan tetap dalam mata uang datar (US $ / €) untuk mengurangi risk pada pasar Blockchain. tidak stable

Article terkait: Memperkenalkan Dimensi Baru Dalam Investasi Kriptocurrency

Each share is offered as a SYMM token that can be traded at the market price so that the holder can withdraw at any time. The initial ICO will last 60 days if the token is offered at a starting value of 0.1 ETH (payable only in Ethereal) before the start of trading. Although these funds are not available to US investors, the management fee is competitive and subject to a fee of 7.5% for investments over 100 ET and 15% for below 100 ET.

About SYMM

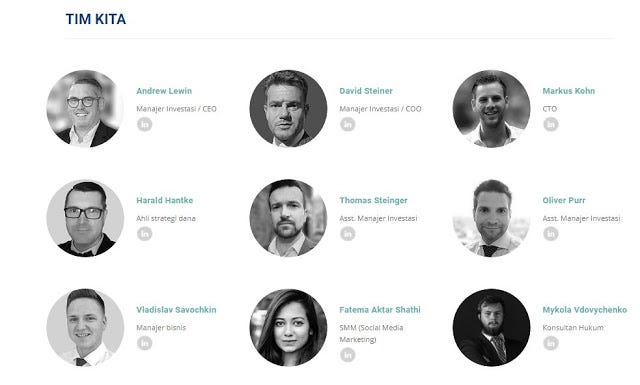

SYMM's investment fund is managed by some of the world's most experienced investment managers, including Andrew Lewin, Senior Fund Manager at Credit Suisse, FX strategist David Steiner and Markus Kohn, a technical architecture expert.

ICO

On the pre-ICO stage, presale and public sales, there will be no discounts.

The price for 1 SYMM is 0.1 ETH. SYMM has two available share classes:

With an investment of more than 100 ETH shares, the SYMM share will have an administrative expenditure of 7.5%. (Class A)

For investments below 100 ETH, the SYMM share will have an administration fee of 15%. (Class B) Hold> 1000 shares of SYMM will automatically receive 7.5% administration fee.

Holding <1000 shares of SYMM will receive a 15% administration fee

New coins are usually listed in the stock and adequate liquidity in 1 to 3 months. Investors will receive a repurchase option during this period or until SYMM is listed on one of the major stock exchanges.

consultant

Summary of ICO SYMM

- A SYMM share corresponds to an ERC-20 compatible token.

- The ICO term is 60 days from 30th November 2017 to 30th January 2018.

- During the ICO, 1 SYMM component is calculated using 0.1 ETH.

- ICO Soft Cap is 3,000 ETH.

- No hard cap for ICO.

- Trading in BTC, LTC, DASH, ET and XRP accounts for 70% of the fund's capital.

- 20% of the funds will invest in potentially high ICOs. SYMM ensures deep discounts (up to 50%)

- ICO, which was not released for public sale.

- 10% of the funds are kept in reserve by the funds to ensure that the entire fund is never exposed at any time.

- 50% of the monthly trading profit is distributed to investors every month. Dividends are paid in ET.

- 50% of the monthly trading profit is used for growth growth.

- To reduce risk and ensure the value of the funds, SYMM funds are held in USD and EUR.

- Risk mitigation strategies are implemented.

- Management fees are not charged if no profit is made.

- Under the scenario of symmetry and projected funds, the estimated annual ROI for the SYMM investor is estimated at more than 50%.

- All shareholders have the opportunity to vote on important financing decisions, further enhancing confidence and transparency between the Fund and its shareholders.

- All transactions executed by SYMM will be listed on the relevant exchanges.

- The funds held by SYMM are subject to external review every month.

- The account balance and the value of the SYMM funds are reported to shareholders on a daily basis.

- Until SYMM is listed on the main exchange, all shareholders have the opportunity to sell their investments for immediate liquidity

trading phase

Following the successful completion of the ICO and the withdrawal of funds from the ICO, the trading phase begins. The trading phase continues indefinitely with changes in trading activities such as trading pairs and the allocation of funds can be selected by shareholders.

At the beginning of the trading phase, the value of SYMM will be capital of 90% of the capital in ICO. This capital is converted into Fiat currency and quoted in USD.

dividend

When SYMM generates a monthly profit, dividends are paid to the shareholders of ETH by intelligent contracts on the 3rd day of each month. Soon, SYMM investors will receive dividends when payment is made to the dividend agreement. Investors can then withdraw money if they choose.

For more information, please visit the following links:

Link to Profile Bitcointalk: https://bitcointalk.org/index.php?action=profile;u=1451221

My ETH: 0xACE2d47039C296a158e6EE1827300e6B098B9B0B

0 komentar: